Get personalized financial advice from a mortgage expert for free so you can buy, sell, or invest with confidence.

Does this sound like you? You...

Want a strategy to buy a home in the current market?

Want to know how to move into a different home when your current one is financed at a very low interest rate ?

Are ready to build a clear, achievable plan to save for a down payment or get better educated about down payment assistance?

Would like to know ways to build or improve your credit?

Are interested in investing in real estate and want to know financing options that are tailored to your goals?

Would like to know how lenders look at your finances and credit before you fall in love with a new home?

Would like to know how much house you can realistically afford without being financially burdened?

No matter what your goals are, you want to improve your financial situation and are ready to cut through the noise and

speak with someone who isn't trying to sell you something.

A free, 20-minute phone call can empower you with the financial knowledge and realistic plan you need to

move forward.

Just 15 minutes on your end. (I'll do the rest 😁.) Let me show you what I mean:

Hi! 👋 I’m Berton.

Husband, Father, Mortgage Consultant, Licensed Loan Officer, and DM.

Before joining the financial industry I’d purchased 3 homes, completely unaware that I'd overpaid thousands of dollars along the way. Turns out, my family and friends had similar stories too. Why? There’s a serious lack of easy to understand, easy to implement information out there to help people be in the best position possible when they want to finance a home.

Now, I help people learn and implement financial strategies before they finance a home or investment property so they can save money, invest more and build generational wealth. I can't wait to help you get started too!

Here's exactly what we go over on a Smart Start call...

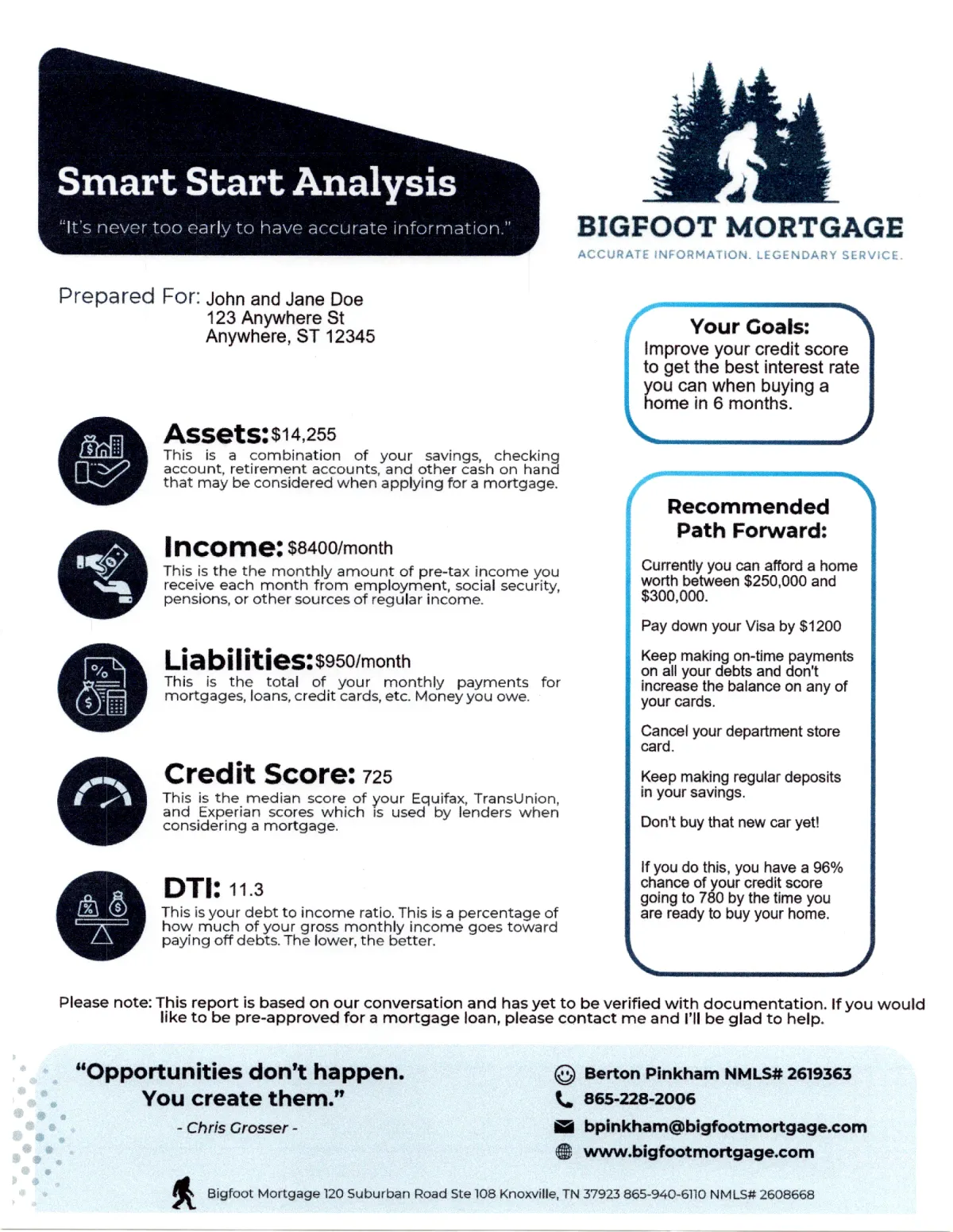

Assets

A combination of

savings, checking, retirement accounts the way LENDERS see them.

Income

Your monthly pre-tax income from employment, social security, pensions, etc.

Liabilities

The total of your monthly payments for mortgages, loans, and credit cards.

Credit Score

Your FICO credit score. The one used by lenders when considering a mortgage.

DTI

Your Debt to Income Ratio. A percentage of how much of your gross monthly income goes toward paying off debts. (The lower, the better.)

If you decide we should pull your credit, I'll use a software package called CreditXpert®, to evaluate your credit and create a tailored plan to improve your score.

After the call, I'll analyze your financial situation and the next day, you'll get a Smart Start report in your inbox, customized to your specific goals.

Here's an example of a Smart Start report:

Smart Start is made for you if you want to:

Prepare for financing a home or investment property.

Learn from loan experts with combined decades of experience who want to teach you what they know so you can benefit.

Avoid surprises during the mortgage approval process.

Improve your credit score to unlock better interest rates and save thousands over the life of a loan.

Talk with someone to get your questions answered...no strings attached.

Frequently Asked Questions

Will my credit score be affected if you pull my credit?

Most of the time when anyone checks credit, the score goes down by a few points then back to where it was after a few weeks. Wouldn't it be nice if someone could give you simple strategies to improve your score? 😊

Is Smart Start guaranteed to improve my credit score?

I'm not going to lie, improving your credit score may require you to change your spending habits. I’m here to give you the information you need, but ultimately, it’s up to you to use it! CreditXpert is a simulator with a high percentage of accuracy. If you follow through with the recommendations in your Smart Start report, your credit score has a high likelihood of going up.

What is CreditXpert?

CreditXpert is software provided by Experian that helps lenders improve borrowers' credit scores. It uses predictive analytics to analyze people's unique credit situation and identify their credit score potential. We use this information, along with your specific goals, to create a plan to improve your credit score with a high percentage of success. Learn more from their website at https://creditxpert.com

My credit score is already pretty high. Do I still need this?

Why not? Most free credit monitoring services only show part of the picture. Smart Start not only gives you your actual FICO score with a plan to make it even better, but you also get feedback on how lenders view your financial situation.

I'm a real estate investor. How will this help me?

Sometimes just a few points of improvement in a credit score can make a lot of difference. For example, I once worked with an investor who had a credit score of 697. All we needed to do was to make a small change to their credit card profile to improve their credit score to over 700. That small change made a .5% difference in the interest rate they were offered, improving their monthly ROI as well as giving them a savings of over $26,000 over the life of the loan!

Schedule your Smart Start call

Get in touch with Bigfoot Mortgage

Email: [email protected]

Address

120 Suburban Road Suite 108, Knoxville, TN 37932

Hours

Mon – Fri 8:00am – 4:00pm or by appointment

Phone Number:

865-346-5554

Legal stuff:

Berton Pinkham NMLS# 2619363

Bigfoot Mortgage NMLS# 2608668 www.nmlsconsumeraccess.org

State Licenses Page: https://canopymortgage.com/state-licenses/

Privacy Policy: https://canopymortgage.com/privacy-policy/

Terms of Use: https://canopymortgage.com/terms-of-use/

Equal Housing Lender

CreditXpert® is a registered trademark of CreditXpert Inc., and does not endorse nor is affiliated with Bigfoot Mortgage in any way. I am an independent mortgage professional using this software for credit analysis.